kottke.org posts about business

Jared Diamond has come to believe that some large multinational companies (like Chevron, Wal-Mart, and Coca-Cola) are “among the world’s strongest positive forces for environmental sustainability”.

The embrace of environmental concerns by chief executives has accelerated recently for several reasons. Lower consumption of environmental resources saves money in the short run. Maintaining sustainable resource levels and not polluting saves money in the long run. And a clean image — one attained by, say, avoiding oil spills and other environmental disasters — reduces criticism from employees, consumers and government.

Lawsuits, bad management, and knockoffs, oh my! From Fast Company:

Discontent has steadily grown among formerly stalwart DWR supporters. New York-based textile designer Sandy Chilewich, whose rugs and mats are stocked by DWR ($280 to $600), says she’s considering pulling her business and has been talking with other DWR designers about banding together to “tell them we don’t approve.” Eames Demetrios, grandson of Charles and Ray Eames and the guardian of their legacy, says, “DWR has been a great ambassador for the Eames story and DWR hasn’t carried knockoff Eames product, but I think one needs to look beyond that. In the long run, we don’t see our authentic product being sold next to knockoff products of any kind.”

A fascinating but short case study of Ferran Adrià’s restaurant El Bulli from the perspective of an MBA.

There is much about the restaurant that is inefficient, as MBAs are quick to note: Adrià should lower his staff numbers, use cheaper ingredients, improve his supply chain, and increase the restaurant’s hours of operation. But “fixing” elBulli turns it into just another restaurant, says Norton: “The things that make it inefficient are part of what makes it so valuable to people.”

In The Gervais Principle, Or The Office According to “The Office” and the followup The Gervais Principle II: Posturetalk, Powertalk, Babytalk and Gametalk, Venkatesh Rao dissects and analyzes the American version of The Office to a degree I hadn’t thought was possible.

After four years, I’ve finally figured the show out. The Office is not a random series of cynical gags aimed at momentarily alleviating the existential despair of low-level grunts. It is a fully-realized theory of management that falsifies 83.8% of the business section of the bookstore.

Even if you’re only an occasional viewer of the show, this is worth reading through, especially if you work in an office environment. (thx, zach)

On the NY Times small business blog, Bruce Buschel shares 50 things restaurant servers and staff should never do. The next 50 will follow next week.

Update: Aaaand here’s the second 50.

Paul Graham asked the founders of the startups he’s funded what they know now that didn’t going in. Here’s what they said.

I’ve been surprised again and again by just how much more important persistence is than raw intelligence.

The airlines that added the most fees (for food, to check bags) in the past few months saw their revenues decline the most.

I thought about his rant this week as the nation’s largest carriers reported first-quarter earnings. Or, more accurately, first-quarter losses. Except for AirTran and JetBlue, they all lost money. The legacy airlines — Delta/Northwest, American, United, Continental and US Airways — lost a lot of money. Collectively about $1.9 billion, in fact. Their revenue plummeted, too.

And do you know what most of them wanted to talk about? You guessed it. The baskets of ancillary revenue they’re harvesting by charging us fees for checking bags, choosing coach seats or whatever. Forget that their houses are burning down. They found a tap in the bathtub with some water leaking out, so they’re thrilled.

(via @kyleridolfo)

So says Caterina Fake:

We agreed that a lot of what we then considered “working hard” was actually “freaking out”. Freaking out included panicking, working on things just to be working on something, not knowing what we were doing, fearing failure, worrying about things we needn’t have worried about, thinking about fund raising rather than product building, building too many features, getting distracted by competitors, being at the office since just being there seemed productive even if it wasn’t — and other time-consuming activities. This time around we have eliminated a lot of freaking out time. We seem to be working less hard this time, even making it home in time for dinner.

I would likely give the same advice, but I wonder if it’s actually true. Perhaps working hard/freaking out was exactly what was needed at the time, whether or not it seems efficient or correct in retrospect. You need to travel that road so you can find a better way the second time around.

This American Life recently aired a follow-up to their well-received program about the recent financial crisis called Return To The Giant Pool of Money.

We catch back up with the people we met in 2008, to see how they’ve fared over the last 18 months. We talk to Clarence Nathan, who in 2008 received a half million dollar loan that he said he wouldn’t have given himself; Jim Finkel, a Wall Street finance guy, who put together and managed complicated mortgage-based financial securities; Richard Campbell, the Marine who was facing foreclosure; and Glen Pizzolorusso, the mortgage company sales manager who led the life of a b-list celebrity.

Few technology and device-making companies probably realize it, but they are in direct competition with Apple (or soon will be). How did this happen? Well, the iPhone1 does a lot of useful things pretty well, well enough that it is replacing several specialized devices that do one or two things really well. Space in backpacks, pockets, and purses is a finite resource, as is money (obviously). As a result, many are opting to carry only the iPhone with them when they might have toted several devices around. Here is a short list of devices with capabilities duplicated to some degree by the iPhone:

Mobile phone - All the stuff any mobile phone does: phone calls, texting, voicemail.

PDA - The iPhone meets all of the basic PDA needs: address book, calendar, to-dos, notes, and easy data syncing.

iPod - The iPhone is a full-featured music-playing device. And with 32 GB of storage, the 3GS can handle a huge chunk of even the largest music collection.

Point and shoot camera - While not as full-featured as something like a PowerShot, the camera on the iPhone 3GS has a 3-megapxiel lens with both auto and manual focus, shoots in low-light, does macro, and can shoot video. Plus, it’s easy to instantly publish your photos online using the iPhone’s networking capabilities and automatically tag your photos with your location.

Personal computer - With the increased speed of the iPhone 3GS, the 3G and wifi networking, a real web browser, and the wide array of available apps at the App Store, many people find themselves leaving the laptops at home and using the iPhone as their main computer when they are out and about.

Nintendo DS or PSP - There are thousands of games available at the App Store and if the folks in my office and on the NYC subway are any indication, people are using their iPhones as serious on-the-go gaming machines.

GPS - With geolocation by GPS, wifi, or cell tower, the Google Maps app, and the built-in compass, the iPhone is a powerful wayfinding device. Apps can provide turn by turn directions, current traffic conditions, satellite and photographic street views, transit information, and you can search for addresses and businesses.

Flip video camera - The iPhone 3GS doesn’t shoot in HD (yet), but the video capabilities on the phone are quite good, especially the on-phone editing and easy sharing.

Compass - Serious hikers and campers wouldn’t want to rely on a battery-powered device as their only compass, but the built-in compass on the iPhone 3GS is perfect for casual wayfinding.

Watch - I use the clock on my iPhone more often than any other function. By far.

Portable DVD player - Widescreen video looks great on the iPhone, you can d/l videos and TV shows from the iTunes Store, and with apps like Handbrake, it’s easy to rip DVDs for viewing on the iPhone.

Kindle - Amazon’s Kindle app for the iPhone is surprisingly usable. And unlike Amazon’s hardware, the iPhone can run many ebook readers that handle several different formats.

With all the apps available at the App Store, the list goes on: pedometer, tape recorder, heart monitor, calculator, remote control, USB key, and on and on. Electronic devices aren’t even the whole story. I used to carry a folding map of Manhattan (and the subway) with me wherever I went but not anymore. With Safari, Instapaper, and Amazon’s Kindle app, books and magazines aren’t necessary to provide on-the-go reading material.

Once someone has an iPhone, it is going to be tough to persuade them that they also need to spend money on and carry around a dedicated GPS device, point-and-shoot camera, or tape recorder unless they have an unusual need. But the real problem for other device manufacturers is that all of these iPhone features — particularly the always-on internet connectivity; the email, HTTP, and SMS capabilities; and the GPS/location features — can work in concert with each other to actually make better versions of the devices listed above. Like a GPS that automatically takes photos of where you are and posts them to a Flickr gallery or a video camera that’ll email videos to your mom or a portable gaming machine with access to thousands of free games over your mobile’s phone network. We tend to forget that the iPhone is still from the future in a way that most of the other devices on the list above aren’t. It will take time for device makers to make up that difference.

If these manufacturers don’t know they are in competition with the iPhone, Apple sure does. At their Rock & Roll event last week, MacWorld quotes Phil Schiller as saying:

iPod touch is also a great game machine. No multi-touch interface on other devices, games are expensive, there’s no app store, and there’s no iPod built in. Plus it’s easier to buy stuff because of the App Store on the device. Chart of game and entertainment titles available on PSP, Nintendo DS, and iPhone OS. PSP: 607. Nintendo DS: 3680. iPhone: 21,178.

The same applies to the iPhone. At the same event, Steve Jobs commented that with the new iPod nano, you essentially get a $149 Flip video camera thrown in for free:

We’re going to start off with an 8GB unit, and we’re going to lower the price from $149 to free. This is the new Apple, isn’t it? (laughter) How are we going to do that. We’re going to build a video camera into the new iPod nano. On the back of each unit is a video camera and a microphone, and there’s a speaker inside as well. Built into every iPod nano is now an awesome video camera. And yet we’ve still retained its incredibly small size.

In discussing the Kindle with David Pogue, Jobs even knocks the idea of specialized devices:

“I’m sure there will always be dedicated devices, and they may have a few advantages in doing just one thing,” he said. “But I think the general-purpose devices will win the day. Because I think people just probably aren’t willing to pay for a dedicated device.”

In terms of this competition, the iPhone at this point in its lifetime2 is analogous to the internet in the late 1990s. The internet was pretty obviously in competition with a few obvious industries at that point — like meatspace book stores — but caught (and is still catching) others off guard: cable TV, movie companies, music companies, FedEx/USPS/UPS, movie theaters, desktop software makers, book publishers, magazine publishers, shoe/apparel stores, newspaper publishers, video game console makers, libraries, grocery stores, real estate agents, etc. etc….basically any organization offering entertainment or information. The internet is still the ultimate “there’s an app for that” engine; it duplicated some of the capabilities of and drew attention away from so many products and services that these businesses offered. Some of these companies are dying — slowly or otherwise — while others were able to adapt and adopt quickly enough to survive and even thrive. It’ll be interesting to see which of the iPhone’s competitors will be able to do the same.

[1] In this essay, I’m using “the iPhone” as a convenient shorthand for “any of a number of devices and smartphones that offer similar functionality to the iPhone, including but not limited to the Palm Pre, Android phones, Blackberry Storm, and iPod Touch”. Similar arguments apply, to varying degrees, to these devices and their manufacturers but are especially relevant to the iPhone and Apple; hence, the shorthand. If you don’t read this footnote, adequately absorb its message, and send me email to the effect of “the iPhone sux because Apple and AT&T are monopolistic robber barons”, I reserve the right to punch you in the face while yelling I WASN’T JUST TALKING ABOUT THE IPHONE YOU JACKASS. ↩

[2] You’ve got to wonder when Apple is going to change the name of the iPhone. The phone part of the device increasingly seems like an afterthought, not the main attraction. The main benefit of the device is that it does everything. How do you choose a name for the device that has everything? Hell if I know. But as far as the timing goes, I’d guess that the name change will happen with next year’s introduction of the new model. The current progression of names — iPhone, iPhone 3G, iPhone 3GS — has nowhere else to go (iPhone 3GS Plus isn’t Apple’s style). ↩

Update: The console makers are worried about mobile phone gaming platforms.

Among the questions voiced by video game executives: How can Nintendo, Sony and Microsoft keep consumers hooked on game-only consoles, like the Wii or even the PlayStation Portable, when Apple offers games on popular, everyday devices that double as cellphones and music players?

And how can game developers and the makers of big consoles persuade consumers to buy the latest shoot’em-ups for $30 or more, when Apple’s App store is full of games, created by developers around the world and approved by Apple, that cost as little as 99 cents — or even are free?

A few weeks ago, Matt Linderman asked the readers of 37signals’ Signal vs. Noise blog for suggestions for a word or phrase to describe a certain type of small, focused company.

Sometimes I’m looking for a word to describe a certain kind of company. One that’s small and cares about quality and is trying to do something great for a few customers instead of trying to mass produce crap in order to maximize profit. A company like Coudal Partners or Zingerman’s.

Boutique was deemed too pretentious…small, indie, and QOQ didn’t cut it either. Readers offered up craftsman, artisan, bespoke, cloudless, studio, atelier, long tail, agile, bonsai company, mom and pop, small scale, specialty, anatomic, big heart, GTD business, dojo, haus, temple, coterie, and disco business, but none of those seems quite right.

I’ve had this question rolling around in the back of my mind since Matt posted it and this morning, a potential answer came to me: small batch. As in: “37signals is a small batch business.” The term is most commonly applied to bourbon whiskey:

A small batch bourbon is made for the true connoisseur, every sip a testament to the work and love that has gone into each handcrafted bottle.

but can also be used to describe small quantities of high quality products such as other spirits, baked goods, coffee, beer, and wine. When starting a small company that makes high quality web sites (Wikirank) and apps (Typekit), some friends of mine in San Francisco even picked the phrase for their company’s name: Small Batch, Inc.

Bottled water is bad but Fiji bottled water is particularly odious. For starters, the country’s military regime monitors internet usage at internet cafes in real-time for information about the popular bottled water brand:

I sat down and sent out a few emails — filling friends in on my visit to the Fiji Water bottling plant, forwarding a story about foreign journalists being kicked off the island. Then my connection died. “It will just be a few minutes,” one of the clerks said. Moments later, a pair of police officers walked in. They headed for a woman at another terminal; I turned to my screen to compose a note about how cops were even showing up in the Internet cafes. Then I saw them coming toward me. “We’re going to take you in for questioning about the emails you’ve been writing,” they said.

Then the cops threatened the reporter with prison rape. The rest of the story isn’t much better.

Update: From Fiji Water’s official response to the article:

We strongly disagree with the author’s premise that because we are in business in Fiji somehow that legitimizes a military dictatorship.

(thx, mason)

I loved this deck of slides from an internal presentation at Netflix on their company’s culture.

This slide deck is our current best thinking about maximizing our likelihood of continuous success.

There are literally dozens of great ideas on these 128 slides…a must-read for anyone who wants their business to grow and last for more than a few years.

From John Gruber, an Apple booster, an essay on Microsoft’s Long, Slow Decline. And, is if in reply, an essay called Apple: Secrecy Does Not Scale from Anil Dash, Microsoft enthusiast. A perhaps unsubtle reply to both essays might be “I can’t hear you over the continual sounds of the cash register”…MS and Apple continue to be enormously profitable doing business the way they do.

Cameron Lester, a partner at a VC firm, on A Golden Age for Venture Capital:

For 14 months, we at Azure Capital tried to invest in companies but could not reach an agreement with entrepreneurs and existing investors on valuation and terms — the gap was too great. Despite meeting with hundreds of companies and reaching the point of discussing terms with a few, we did not make a single new investment.

That gap no longer exists. We recently invested in a company called BlogHer in May. It is an exciting company, whose team and investors were wise enough to realize that taking money now would give them a competitive advantage. And last week we invested in SlideRocket, our second new investment in less than two months.

It is as if the venture-funding environment has finally hit the reset button.

Translation: Now that money is tight, venture capital firms are able to fully dictate the terms of their investments. Entrepreneurs, prepare to part with more of your companies than you wanted to and receive less for the pleasure. Lester goes on to hand-wavingly assert that this is a good thing for entrepreneurs.

I don’t think I’ve ever worked on a project of this magnitude before so this was a bit of a revelation to me: when your customer base reaches a certain size, you stop having edge cases.

Mistakes, bugs, incompatibilities, and related issues that used to affect a handful now affect hundreds. 1% is real number now. This requires some organizational change. More caution, more testing, more contingency planning, more disaster planning.

This is likely the reason why customer service for large services is so difficult (to the point that almost no one gets it right): every little problem is actually a big problem. See also why writing software is easy but writing stable, scalable, engaging, polished software is not something for a weekend hack and Too Big to Succeed.

CNNMoney tells us about seven great companies to work for. For instance, a Colorado brewing company gives their employees free beer and company ownership.

After one year of work, each employee receives an ownership stake in the company and a free custom bicycle. After five years every employee enjoys an all-expenses-paid trip to Belgium — the country whose centuries-old beer tradition serves as a model for the Fort Collins, Colo., brewery. Oh yeah, and employees get two free six-packs of beer a week.

Taking a cue from auto insurance, Safeway has devised a healthcare insurance plan that emphasizes personal responsibility.

Safeway’s plan capitalizes on two key insights gained in 2005. The first is that 70% of all health-care costs are the direct result of behavior. The second insight, which is well understood by the providers of health care, is that 74% of all costs are confined to four chronic conditions (cardiovascular disease, cancer, diabetes and obesity). Furthermore, 80% of cardiovascular disease and diabetes is preventable, 60% of cancers are preventable, and more than 90% of obesity is preventable.

The result is that Safeway’s healthcare costs have held steady over the past four years while the costs at other American companies have increased almost 40%.

What I Learned Today crunches the numbers on GM and the results are not pretty.

So $83,000,000,000 is what New GM would have to be worth in order for us to break even on our investment. But $56,000,000,000 is what GM was worth at its all time peak in 2000.

Bud Caddell summarizes how to be happy with your work in the form of a Venn diagram consisting of three main overlapping areas: What We Do Well, What We Want to Do, and What We Can Be Paid to Do. (via today and tomorrow)

GM declared bankruptcy yesterday and the rush is on to explain what went wrong. Here are a few explanations I found, along with some possible solutions.

After 101 years, why GM failed, Peter Cohan, DailyFinance:

4. Failure to innovate. Since GM was focused on profiting from finance, it did not really care that much about building better vehicles. GM’s management failed to adapt GM to changes in customer needs, upstart competitors, and new technologies.

Seven reasons GM is headed to bankruptcy, Sharon Silke Carty, USA Today:

When GM realized how fast 1990s buyers were switching to trucks as personal transportation, it overreacted, pouring time and money into SUVs and pickups at the expense of car development. The result: As long ago as 2000, Wall Street was warning that GM could be overcommitted to trucks and wind up out of phase if the pendulum of buyer preference swung back to cars. Once consumer tastes began changing, the market was awash in new truck models, and profits were sapped by discounts needed to keep sales boiling.

Goodbye, GM, Michael Moore:

The products built in the factories of GM, Ford and Chrysler are some of the greatest weapons of mass destruction responsible for global warming and the melting of our polar icecaps. The things we call “cars” may have been fun to drive, but they are like a million daggers into the heart of Mother Nature. To continue to build them would only lead to the ruin of our species and much of the planet.

G.M.’s Road From Prosperity to Crisis, NY Times:

The company reached a deal with Saab to expand its European presence. Having an extensive brand lineup had been a primary strategy at G.M. since its creation in 1908. But this tactic eventually became costly, as brands overlapped and competed for business and money.

GM Reinvention, GM. Twitter, Flickr, Facebook, it’s all there. Oy.

Ten Vehicles That Bankrupted GM, Matt Hardigree, Jalopnik:

The Pontiac Aztec was one of the first major crossover vehicles brought to market in the U.S. [It was] combination of car-like handling and fuel economy with SUV-like space and aggressive appearance. The concept was a hit and now most automakers are shifting towards crossover. The Aztec was a massive failure. It was an attractive idea in an amazingly unattractive shell. It failed almost entirely based upon its appearance.

Who’s to Blame for GM’s Bankruptcy?, William J. Holstein, BusinessWeek:

GM simply was not ready to respond to Toyota Motor and other Japanese manufacturers when they began to gain serious ground in the early 1980s. Toyota, in particular, had developed a lean manufacturing system that was completely different from the mass-assembly-line techniques GM was still using, many decades after Henry Ford perfected them. GM’s fractured structure meant that each division had its own manufacturing processes, its own parts, its own engineering, and its own stamping plants.

How GM Lost Its Way, Paul Ingrassia, WSJ:

The picture of a heedless union and a feckless management says a lot about what went wrong at GM. There were many more mistakes, of course — look-alike cars, lapses in quality, misguided acquisitions, and betting on big SUVs just before gas prices soared. They were all born of a uniquely insular corporate culture.

The Quagmire Ahead, David Brooks, NY Times:

Over the last five decades, this company has progressively lost touch with car buyers, especially the educated car buyers who flock to European and Japanese brands. Over five decades, this company has tolerated labor practices that seem insane to outsiders. Over these decades, it has tolerated bureaucratic structures that repel top talent. It has evaded the relentless quality focus that has helped companies like Toyota prosper.

The End of the Affair, P.J. O’Rourke, WSJ:

We became sick and tired of our cars and even angry at them. Pointy-headed busybodies of the environmentalist, new urbanist, utopian communitarian ilk blamed the victim. They claimed the car had forced us to live in widely scattered settlements in the great wasteland of big-box stores and the Olive Garden. If we would all just get on our Schwinns or hop a trolley, they said, America could become an archipelago of cozy gulags on the Portland, Ore., model with everyone nestled together in the most sustainably carbon-neutral, diverse and ecologically unimpactful way.

Why GM failed, Jack Lessenberry, Detroit Metro Times:

What’s wrong, in a nutshell, is that it is a narrow, insular culture. Those who make it to the top of the heap, like Rick Wagoner, tend to be white Anglo-Saxon Protestant males who have worked at the same company their entire career, and have come up with the same set of buddies. Sort of like the Delta Tau Delta fraternity Wagoner joined when he was in business school.

Update: The WSJ’s Photo Journal blog has photos and brief stories of a number of people affected by GM’s bankruptcy. Gary Thomas, a mechanic from Kingston, TN, put about $800,000 in GM bonds.

“I thought I was doing the right thing. I wasn’t investing in stocks. GM was a solid company. … The bonds were my entire nest egg. I’m not a whiner and I don’t want special treatment. What really ticks me off is that it seems like we are getting less than everyone else and we deserve to be treated equally. I’m just trying to figure out a way to make it to 65 so I can start drawing my social security.”

Update: After Many Stumbles, the Fall of a Giant, Micheline Maynard, NY Times:

The company did have vast numbers of loyal buyers, but G.M. lost them through a series of strategic and cultural missteps starting in the 1960s. It bungled efforts in the 1980s to cut costs by sharing the underpinnings of its cars across different brands, blurring their distinctiveness. G.M. gave in to union demands in 1990 and created a program that paid workers even when plants were not running, forcing it to build cars and trucks it could not sell without big incentives.

Update: Salutary lessons from the downfall of a carmaker, John Kay, Financial Times:

The factors that had once been the company’s strengths were now weaknesses. Mass production and piece-rate incentives created a workforce with little pride in the quality of the product. The cadre of professional managers became a complacent, inward-looking bureaucracy. The diversified corporation became a collection of competing baronies.

From a couple of years ago, The Risk Pool, Malcolm Gladwell, The New Yorker:

Surely, if you are losing money on every car you sell, as G.M. is, cutting car prices still further in order to boost sales doesn’t make any sense. It’s like the old Borsht-belt joke about the haberdasher who lost money on every hat he made but figured he’d make up the difference on volume. The economically rational thing for G.M. to do would be to restructure, and sell fewer cars at a higher profit margin — and that’s what G.M. tried to do this summer, announcing plans to shutter plants and buy out the contracts of thirty-five thousand workers. But buyouts, which turn active workers into pensioners, only worsen the company’s dependency ratio. Last year, G.M. covered the costs of its four hundred and fifty-three thousand retirees and their dependents with the revenue from 4.5 million cars and trucks. How is G.M. better off covering the costs of four hundred and eighty-eighty thousand dependents with the revenue from, say, 4.2 million cars and trucks?

NASCAR helped GM down its path of self-destruction, Viv Bernstein, True/Slant:

How ironic, given NASCAR’s role in helping the auto industry race down its path of self-destruction. Major auto companies used NASCAR for years to push cars and trucks with poor fuel economy numbers. The sport, in some ways, came to symbolize America’s embrace of consumption. Consider that NASCAR didn’t even switch to unleaded gasoline until 2007. And even today, the racecars and trucks that auto companies are marketing through NASCAR are among the least fuel efficient, from the Dodge Charger to the Chevrolet Silverado.

(thx, fargo & coates)

Another one of those “you can haggle everywhere — even at Wal-Mart and the dollar store! — if you can work up the courage to do so” stories. These are like crack for my fraidy-cat non-negotiating ass.

According to Doble, you can haggle pretty much anywhere — from Macy’s to Kmart to your local supermarket — but, he suggests, your best bets are hotel rooms, bulk purchases, big-ticket items, anything marked down or damaged, floor models, used items or open packages. In those situations, says Doble, “It’s almost crazy not to bargain.” After all, merely asking for a better price — on, say, an appliance — can save you hundreds of dollars.

(via rebecca’s pocket)

Joel Spolsky sings the praises of B&H, the mega photography and electronics store on 34th Street in Manhattan.

No, wait: The most amazing thing is that I have often gone into B&H to purchase a specific product, only to be talked into something cheaper. For example, once I went in to buy a field video monitor to use for some interviews I was conducting. I expected to pay $600 until the salesperson said, “Why don’t you just get one of these cheap consumer portable DVD players? They have video inputs, they work just as well, and they’re under $100.” This was no accident. “The entire premise of our store is based upon your ability to come in, touch, feel, experiment, ask, and discuss your needs without sales pressure,” B&H’s website says.

Re: Circuit City, I’d wager that many of the businesses that have gone under so far have not done so because of the poor economy but because they were poor or unsustainable businesses. (via @anildash)

Georg Jensen aruges that the USPS has, in effect, turned into a huge mail spamming operation (among other problematic aspects of the organization).

Just as General Motors has in effect subsidized Big Oil by continuing to build gas-guzzlers in recent years, so has the USPS continued to subsidize Big Mail by shaping its operations to encourage what it now calls, revealingly, “standard mail” — that is, advertising junk mail. Most American citizens are blissfully unaware of the degree to which USPS subsidizes U.S. businesses by means of the fees it collects from ordinary postal customers. For example, if you wish to mail someone a large envelope weighing three ounces, you’ll pay $1.17 in postage. A business can bulk-mail a three-ounce catalog of the same size for as little as $0.14.

Sometimes I link to stuff only because it justifies my organizational laziness. See: Ready, aim…fail.

A few management scholars are now looking deeper into the effects of goals, and finding that goals have a dangerous side. Individuals, governments, and companies like GM show ample ability to hurt themselves by setting and blindly following goals, even those that seem to make sense at the time.

I’ll continue stumbling towards the light at the end of the tunnel, thank you very much.

Feeling undervalued, some magazines are raising their prices and gaining both readership and revenue.

The Economist is leading the charge on expensive subscriptions, and its success is one reason publishers are rethinking their approaches. It is a news magazine with an extraordinarily high cover price — raised to $6.99 late last year — and subscription price, about $100 a year on average.

Even though The Economist is relatively expensive, its circulation has increased sharply in the last four years. Subscriptions are up 60 percent since 2004, and newsstand sales have risen 50 percent, according to the audit bureau.

I’m always amazed that something as great as The New Yorker can be had for a buck an issue when people routinely pay $4 for burnt coffee, $10 for crappy movies, and $12 for -tini drinks.

Mark Penn, a former Clinton pollster, writes in the Wall Street Journal that:

In America today, there are almost as many people making their living as bloggers as there are lawyers.

Understandably, Penn’s catching a bit of flack for that and statements and the numbers he uses to back them up. From Waldo Jaquith at VQR:

Penn’s thesis is that average American citizens are becoming professional bloggers, offsetting the loss in journalists, with millions enjoying a revenue stream from blogging and nearly half a million making a living at it. That’s wrong on its face. There’s simply no way there there’s more than, say, 10,000 Americans are paying for their basic life expenses purely through blogging.

Scott Rosenberg, who has done all sorts of research about blogging for his forthcoming book, reacted similarly:

Technorati’s are the longest-running and most valuable, and consistent, series of blogging studies over time, but like any study’s numbers, they can be easily misrepresented: here, Penn relies on them for the datum that bloggers who reach 100,000 uniques a month can earn $75K a year. But if you read the source, you find this:

“The average income was $75,000 for those who had 100,000 or more unique visitors per month (some of whom had more than one million visitors each month). The median annual income for this group is significantly lower - $22,000.”

In other words, the $75K average is skewed by a handful of outlier successes, but the great majority of bloggers who get 100,000 uniques/month earn more like $22,000. Here, the median is far more relevant than the average. Penn, of all people, knows this.

From my perspective as someone who does make a living blogging, Penn’s numbers, especially this 100,000 uniques —> $75K business, are misleading at best and a complete fucking lie at worst.

A study from the BI Norwegian School of Management has found online music bootleggers are much more likely to pay for music online than those who don’t steal music.

The Norwegian study looked at almost 2,000 online music users, all over the age of 15. Researchers found that those who downloaded “free” music — whether from lawful or seedy sources — were also 10 times more likely to pay for music. This would make music pirates the industry’s largest audience for digital sales.

Not surprising that some people are so crazy for music that they’ll *pay* for it. Crazy!

Update: Rebecca Blood thinks this article is crappity crap crap and points to a better take at Ars Technica.

Adrian Shaughnessy shares ten paradoxes about graphic design; by paradox he means “an opinion or statement contrary to commonly accepted wisdom”. I particularly liked these two bits of wisdom:

As part of their training, all designers should be obliged to spend a sum of their own money on graphic design.

And:

If we want to make money as a graphic designer, we must concentrate on the work — not the money.

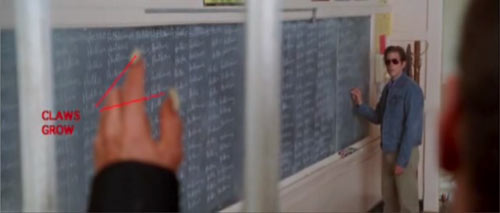

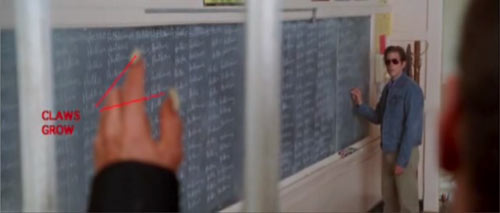

An incomplete version of the Wolverine movie was leaked online last week. A screencap found online shows just how incomplete it was in places.

An online reviewer for Fox News named Roger Friedman saw the movie and reviewed it positively in his column.

This may be the big blockbuster film of 2009, and one we really need right now. It’s miles easier to understand than “The Dark Knight,” and tremendously more emotional. Hood simply did an outstanding job bringing Wolverine’s early life to the screen.

Fox News is owned by News Corp. 20th Century Fox, the company putting out Wolverine, is also owned by News Corp. You can see where this is heading. Friedman is now out of a job and a large media company has once again made its priorities clear:

We’ve just been made aware that Roger Friedman, a freelance columnist who writes Fox 411 on Foxnews.com — an entirely separate company from 20th Century Fox — watched on the Internet and reviewed a stolen and unfinished version of ‘X-Men Origins: Wolverine.’ This behavior is reprehensible and we condemn this act categorically — whether the review is good or bad.

Translation: we’re more concerned with piracy than with the quality of the film as perceived by the audience. I bet the filmmakers are happy that someone really liked the film.

Newer posts

Older posts

Stay Connected