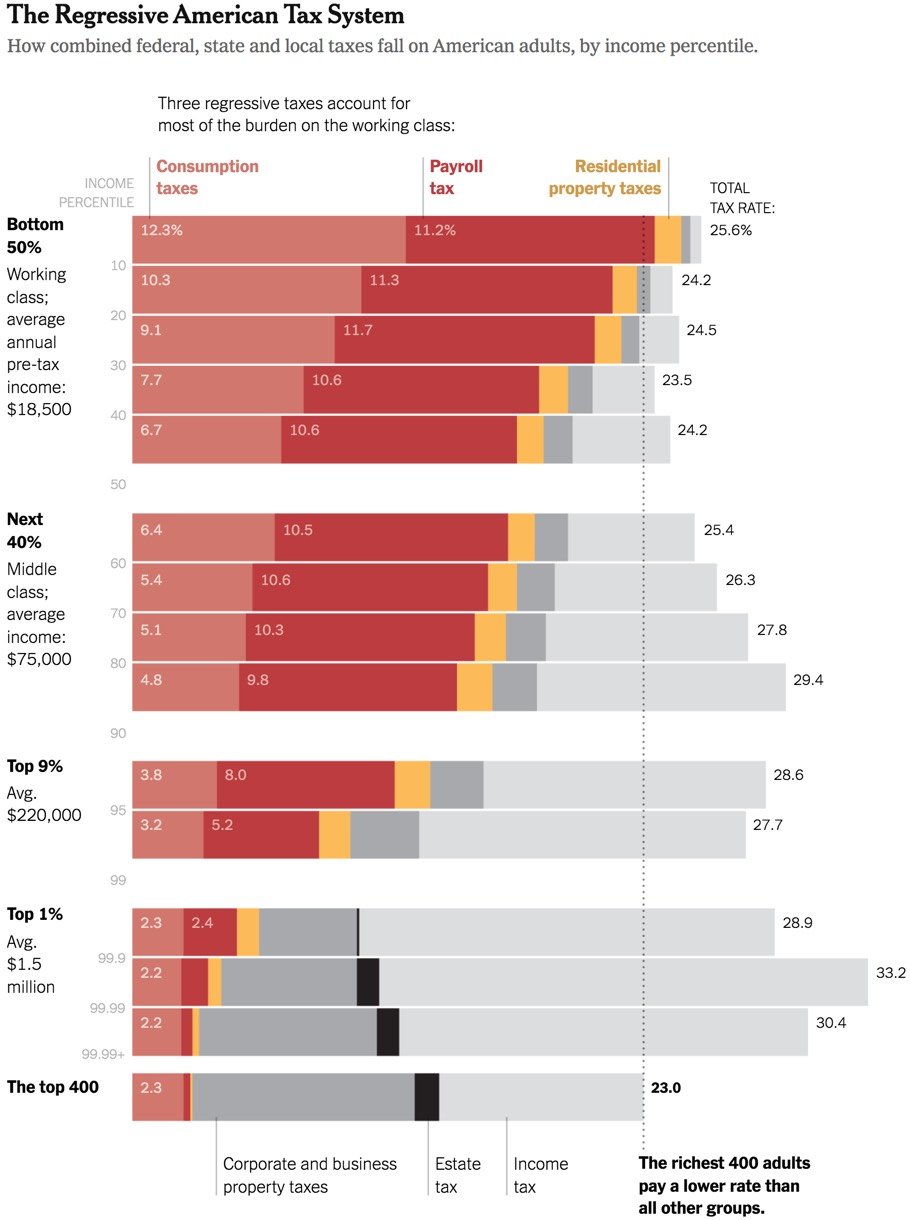

America’s Unjust Regressive Tax System and How to Fix It

On Monday, I posted a link to David Leonhardt’s NY Times piece, The Rich Really Do Pay Lower Taxes Than You.

For the first time on record, the 400 wealthiest Americans last year paid a lower total tax rate — spanning federal, state and local taxes — than any other income group, according to newly released data. That’s a sharp change from the 1950s and 1960s, when the wealthy paid vastly higher tax rates than the middle class or poor. Since then, taxes that hit the wealthiest the hardest — like the estate tax and corporate tax — have plummeted, while tax avoidance has become more common. President Trump’s 2017 tax cut, which was largely a handout to the rich, plays a role, too. It helped push the tax rate on the 400 wealthiest households below the rates for almost everyone else.

The result is a tax system that is much less progressive than it used to be. And unjust. The economists who compiled this data, Emmanuel Saez and Gabriel Zucman, have written a book called The Triumph of Injustice: How the Rich Dodge Taxes and How to Make Them Pay. In this piece called How to Tax Our Way Back to Justice, the pair lay out the problem and how we can fix it to make our tax system more just for the majority of Americans.

The good news is that we can fix tax injustice, right now. There is nothing inherent in modern technology or globalization that destroys our ability to institute a highly progressive tax system. The choice is ours. We can countenance a sprawling industry that helps the affluent dodge taxation, or we can choose to regulate it. We can let multinationals pick the country where they declare their profits, or we can pick for them. We can tolerate financial opacity and the countless possibilities for tax evasion that come with it, or we can choose to measure, record and tax wealth.

If we believe most commentators, tax avoidance is a law of nature. Because politics is messy and democracy imperfect, this argument goes, the tax code is always full of “loopholes” that the rich will exploit. Tax justice has never prevailed, and it will never prevail. […] But they are mistaken.

Stay Connected