kottke.org posts about Burger King

I’d like to take a brief moment at the end of this weird and difficult week to appreciate this monogram that’s part of Burger King’s new brand identity.

B + K + burger = perfect. I hereby dub this new tiny logo “The Slider”. It was designed by Stephen Kelleher Studio; you can see some of their other “explorations” as they worked on refining the finished monogram. Reminds me of Sandwich’s excellent logo.

Joining Carl’s Jr. and White Castle, Burger King is adding a tastes-like-beef veggie burger to their menu.

This week, Burger King is introducing a version of its iconic Whopper sandwich filled with a vegetarian patty from the start-up Impossible Foods.

The Impossible Whopper, as it will be known, is the biggest validation — and expansion opportunity — for a young industry that is looking to mimic and replace meat with plant-based alternatives.

The roll-out will start in the chain’s St. Louis restaurants and then proceed nationwide if all goes well. Here’s a commercial in which hardcore BK fans can’t tell the Impossible Whopper from their beloved beef version:

As an increasingly conflicted omnivore, I would be perfectly happy if all low- to mid-end burgers were replaced by veggie clones — I don’t care that the Quarter Pounder I eat once every three months is beef…I just want it to taste like a Quarter Pounder — and then high-end burgers (the ones where you can tell the difference and you eat only rarely) were made from humanely raised beef for which consumers pay an appropriate price that accurately reflects the true-cost accounting of their production. A meat burger that costs a dollar is just being paid for in other ways by someone or something else.

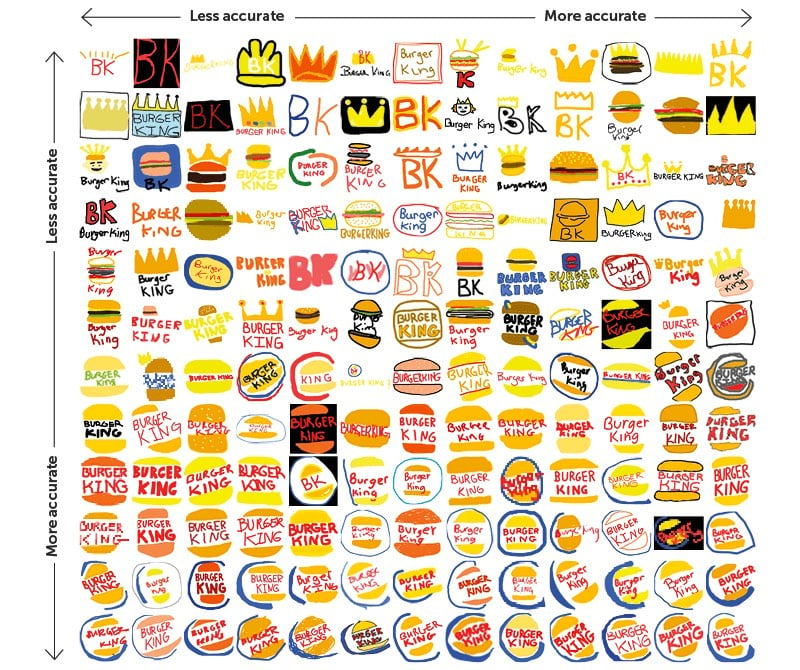

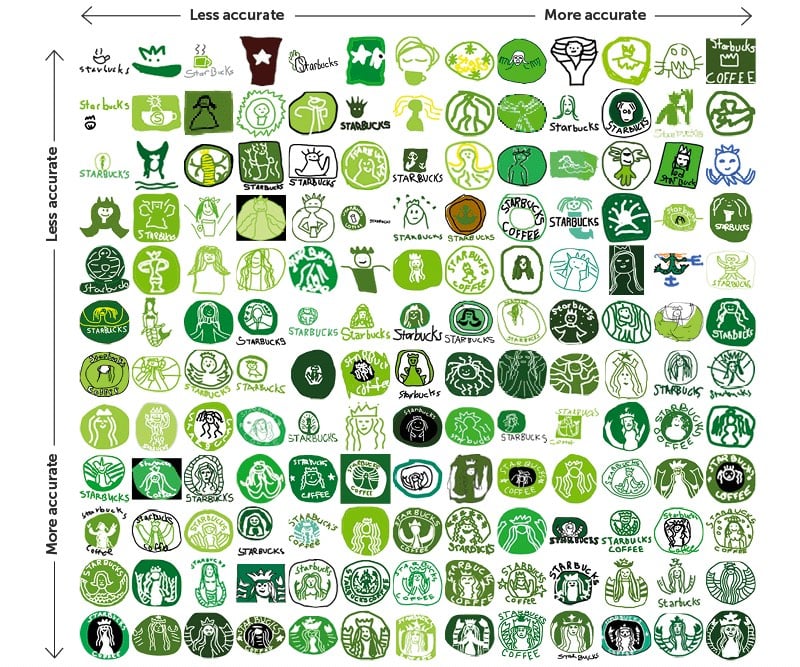

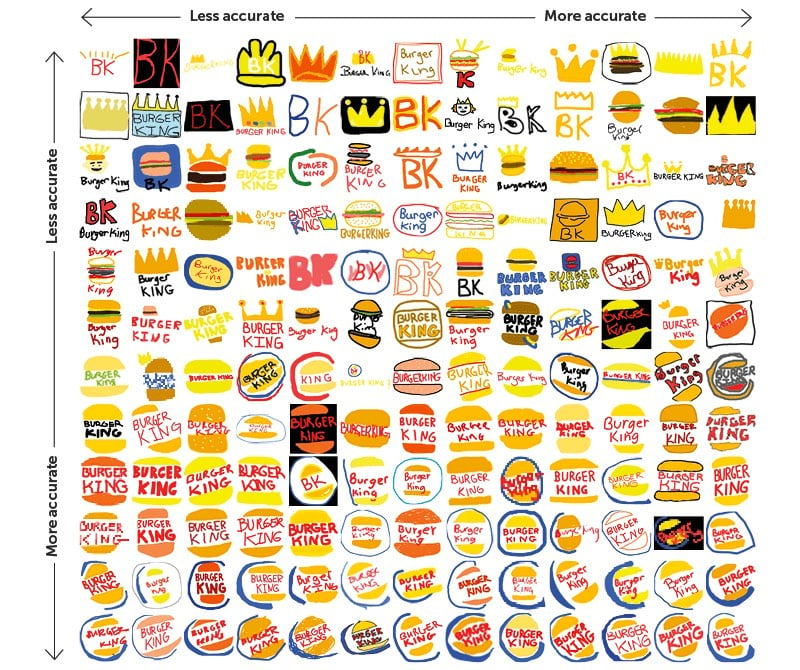

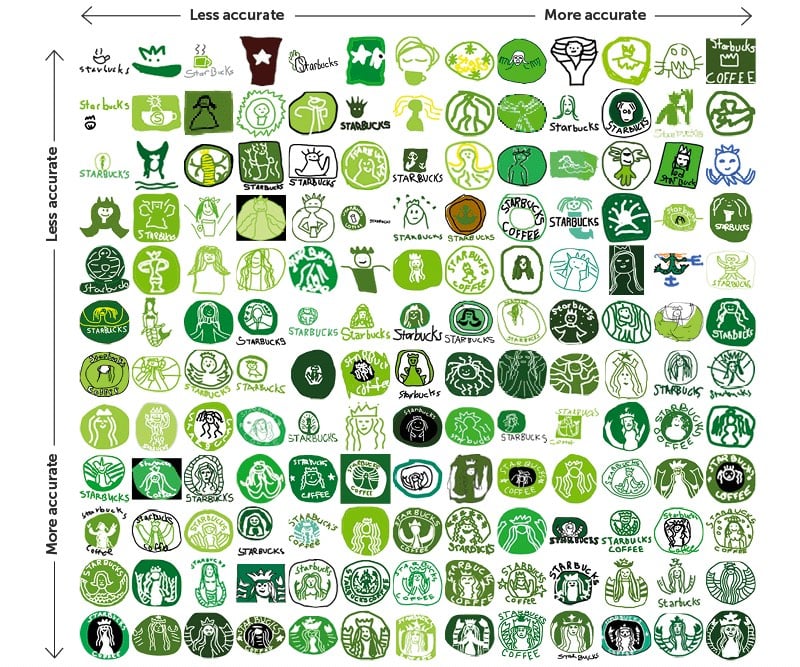

Signs.com asked dozens of Americans to draw the logos of well-known companies from memory, including Domino’s, Apple, Adidas, and Starbucks. As you can see, there was a wide range in aptitude and some logos fared better than others; overall the Starbucks and Foot Locker logos were the worst drawn while Ikea and Target were the best represented.

There is also this (a true story):

Adidas, the second largest sportswear company in the world, acquired its three-stripes logo in 1952 from footwear brand Karhu Sports for two bottles of whiskey and the equivalent of $2,000.

See also drawing all 50 states from memory, can you draw a working bicycle from memory?, and maps drawn from memory.

This is a five-minute video of Andy Warhol eating a Burger King hamburger accompanied by Heinz ketchup.

The scene is part of a film done by Jorgen Leth called 66 scenes from america.

Leth had his assistant buy some burgers and directly advised him to buy some in halfway neutral packaging as Leth was afraid that Warhol might reject some brands (Warhol always had an obsession with some of his favorite brands).

So Andy Warhol finally did arrive at the studio, of course along with his bodyguards, and when he saw the selection of burgers the assistant had brought he asked “Where is the McDonald’s?” and Leth — slightly in panic — was immediately like “I thought you would maybe not like to identify…” and Warhol answered “no that is the most beautiful”. Leth offered to let his assistant quickly run to McDonald’s but Warhol refused like “No, never mind, I will take the Burger King.”

(via bon appetit)

Facebook’s going public in a few days and will finally get a real valuation attached to it. During a 2009 Burger King promotion that doled out free Whoppers for deleting some of your Facebook friends, I estimated Facebook’s valuation at about $1.8 billion.

What BK has unwittingly done here is provide a way to determine the valuation of Facebook. Let’s assume that the majority of Facebook’s value comes from the connections between their users. From Facebook’s statistics page, we learn that the site has 150 million users and the average user has 100 friends. Each friendship is requires the assent of both friends so really each user can, on average, only end half of their friendships. The price of a Whopper is approximately $2.40. That means that each user’s friendships is worth around 5 Whoppers, or $12. Do the math and:

$12/user X 150M users = $1.8 billion valuation for Facebook

At the time, Facebook’s estimated worth was anywhere between $9-15 billion, about an order of magnitude more than the company’s 2009 Whopper valuation. According to the company’s Key Facts page, Facebook has 901 million monthly active users as of the end of March 2012. Doing the math again:

$12/user X 901M users = $10.8 billion valuation for Facebook

Right now, the price range for the IPO is $34-38 a share which would put the company’s overall valuation at $104 billion, the same order of magnitude more than the current Whopper valuation.

Now, I’m no economist, but that’s a lot of hamburgers.

My inbox is divided about the valuation of Facebook calculated using Burger King Whopper Sacrifice promotion (unfriend 10 people to get a Whopper). The majority say that even if you prevented people from refriending those they unfriended for a Whopper, a value of 12 cents for each friend link is too high and that most links are worth much less than that. That is, Facebook is awash in junk friendships of little value.

A smaller contingent is arguing that Burger King would have to pay much more to break some friendships and that Facebook’s valuation is therefore higher than the straight calculation indicates. For instance, getting Johnny Shoegazer to unfriend that girl he likes might take a considerable sum of money. I agree that Facebook is worth more than $1.8 billion in Whoppers but not because some individual links are more valuable than others…it’s about groups and networks of links. You might be able to get someone to part with 10 “junk” friends for $2.40 but could you pay them $22 more to essentially shut down their Facebook account for good? I don’t think so. It’s going to cost much more than that…and for some intense users of the site, the “buyout” amount might be surprisingly high. (I’d probably accept $24 to close my Facebook account. But I pay nothing to use Twitter and ~$25 a year for Flickr and it might take several hundred or even thousands of dollars to entice me to permanently close either of those accounts…I get so much value from them.)

The reason for this seems like it might have something to do with Metcalfe’s Law:

Metcalfe’s law states that the value of a telecommunications network is proportional to the square of the number of connected users of the system (n^2). […] Metcalfe’s law characterizes many of the network effects of communication technologies and networks such as the Internet, social networking, and the World Wide Web. It is related to the fact that the number of unique connections in a network of a number of nodes (n) can be expressed mathematically as the triangular number n(n - 1)/2, which is proportional to n^2 asymptotically.

Or for our economic purposes, the network effect:

In economics and business, a network effect (also called network externality) is the effect that one user of a good or service has on the value of that product to other users. The classic example is the telephone. The more people own telephones, the more valuable the telephone is to each owner. This creates a positive externality because a user may purchase their phone without intending to create value for other users, but does so in any case.

As Facebook accumulates users and friendship links, the service becomes more and more valuable for each user. In Whoppernomics terms, Facebook may well be worth the $15 billion that the Microsoft deal suggested, but there are obviously problems for Facebook in thinking about their value in this way. How do they extract that value from their users? Getting a user to accept a $500 buyout for their Facebook account is different than Facebook asking that user to pay $500 to keep using their account even though the monetary value of the account is the same in either case. What Facebook is betting on is that each user will put up with hundreds of dollars worth of distractions (in the form of advertising and promotions) from their primary goal on the site (i.e. connecting with friends). Also, as Friendster and MySpace and every other social networking site has learned, membership in these services is not exclusive and users may eventually find more value in some other network with (temporarily) less distraction.

Again, assuming that we’re not taking this too seriously.

Burger King recently introduced a Facebook app called Whopper Sacrifice that allows users to delete ten of their friends in exchange for a Whopper sandwich. Watch the app in action.

What BK has unwittingly done here is provide a way to determine the valuation of Facebook. Let’s assume that the majority of Facebook’s value comes from the connections between their users. From Facebook’s statistics page, we learn that the site has 150 million users and the average user has 100 friends. Each friendship is requires the assent of both friends so really each user can, on average, only end half of their friendships. The price of a Whopper is approximately $2.40. That means that each user’s friendships is worth around 5 Whoppers, or $12. Do the math and:

$12/user X 150M users = $1.8 billion valuation for Facebook

That’s considerably less than the $15 billion valuation assigned to Facebook when Microsoft invested in the company in October 2007 and the lower valuations being tossed about in recent months.

P.S. Other assumptions for the sake of argument: every user is eligible for the Whopper promotion (it’s actually only valid in the US), you can sell all of your friends for multiple burgers (actually limit one per customer), and the “average user has 100 friends” means that Facebook users average 100 friends apiece (no idea what the reality is…if they’re using the median instead of the mean then that number could be higher or lower). Oh, and it’s also assumed that no one should take this too seriously.

Update: I’m getting some email saying that Facebook friendships require the assent of both parties. Is that the way it works for the BK thing? If I am friends with Mary and I unfriend her through the Whopper Sacrifice app, is she then unable to unfriend me to help get her burger? If so, then the $3.6 billion valuation drops to $1.8 billion because each unfriending event takes care of 2 friend connections, not just one. Anyone? Note: we are already taking this too seriously!

Update: Ok, it looks like unfriending on Facebook takes out two friendship connections, not just one. So that drops each user’s share to $12 and the valuation to $1.8 billion. D. Final answer, Regis. (thx, everyone)

Socials & More