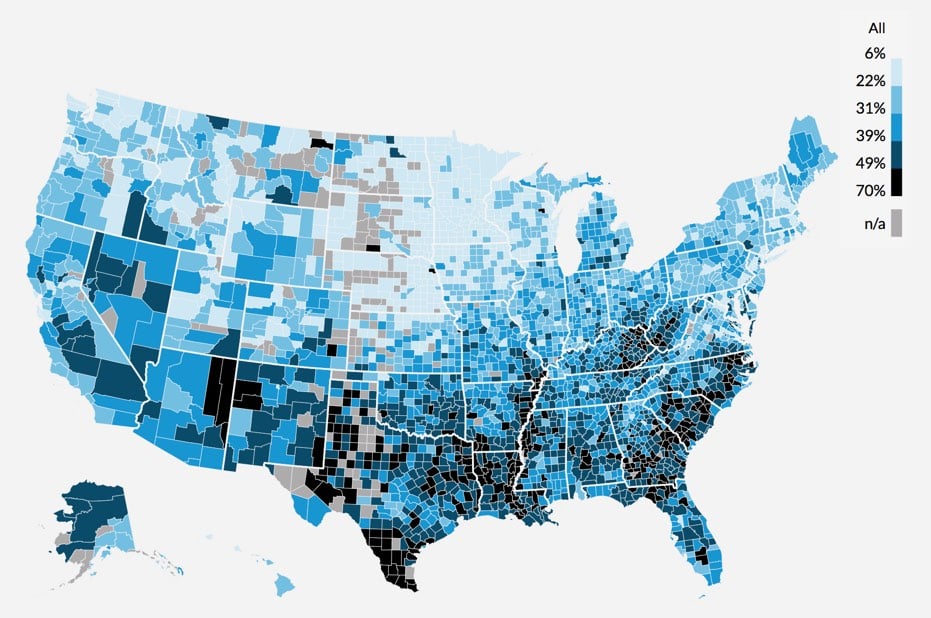

An interactive map of debt in America

The Urban Institute has built an interactive map for exploring debt in America.

Credit can be a lifeline during emergencies and a bridge to education and homeownership. But debt-which can stem from credit or unpaid bills-often burdens families and communities and exacerbates wealth inequality. This map shows the geography of debt in America at the national, state, and county levels.

I’d love to hear why the “share with any debt in collections” is so relatively low in the Upper Midwest, Minnesota in particular.

Update: Unsurprisingly, health insurance coverage is a significant factor in American debt…and Minnesota has a low rate of medical debt in collections along with a relatively low rate of uninsured. This 2016 press release from MN Department of Health provides some clues as to why the uninsured rate is so comparatively low. (via @yodaui)

Socials & More